Introduction

In the rapidly evolving world of blockchain technology, significant advancements are continually shaping the landscape. One such advancement is the integration of Chainlink with Real-World Assets (RWA), which has stirred much interest among crypto enthusiasts and investors alike. With an astounding $4.1 billion lost to DeFi hacks in 2024, the necessity for robust security protocols and integrations has never been clearer.

In this article, we will delve into the integration of Chainlink with RWA. We will explore its implications for the future of digital assets, focusing on how this integration can transform financial markets and provide insights into the latest news surrounding it.

The Importance of Chainlink RWA Integration

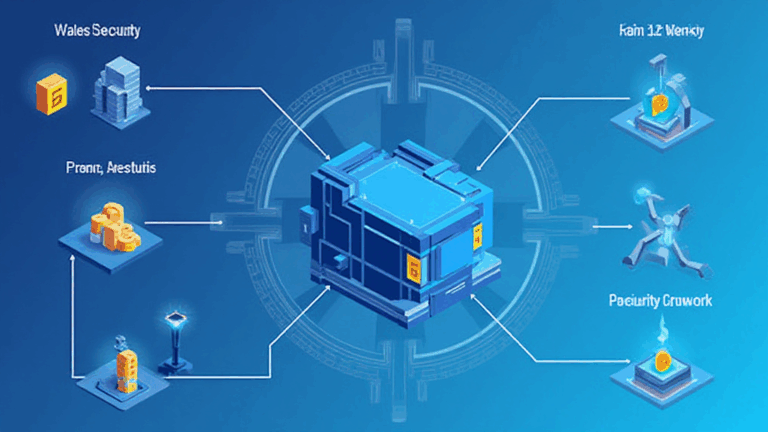

The integration of Chainlink with RWA marks a pivotal moment in how on-chain and off-chain assets interact. By enabling smart contracts to securely access real-world data, Chainlink provides a bridge that enhances the functionality of decentralized finance (DeFi) applications. This integration not only boosts the security of transactions but also leads to increased trust among users.

What Are Real-World Assets?

Real-world assets refer to physical or tangible assets, such as real estate, commodities, and even financial instruments. The tokenization of these assets can enable unprecedented liquidity and accessibility in financial markets. For example, a property can be tokenized and sold as fractional shares on the blockchain, allowing investors to buy into assets with lower capital requirements.

Benefits of Integrating RWA with Chainlink

- Enhanced Security: Chainlink provides tamper-proof data feeds, which enhance the security of RWA transactions.

- Increased Liquidity: Tokenization opens avenues for greater liquidity in traditionally illiquid markets.

- Accessibility: Investors from around the globe can access tokenized assets, democratizing investment opportunities.

Exploring the Vietnamese Market: A Growing Interest in Chainlink

The interest in blockchain technology in Vietnam is surging, with a 120% increase in crypto users in 2025. This growth presents a promising opportunity for Chainlink as Vietnamese investors look for reliable and secure ways to enter the crypto space. Integrating RWA through Chainlink can position it as a leading choice for both local and international investors seeking exposure to tokenized assets.

According to recent studies, the adoption of blockchain technology in Vietnam is expected to increase by an additional 50% by 2026, furthering the demand for decentralized solutions.

Real-World Use Cases of Chainlink RWA Integration

Understanding the practical applications of Chainlink’s integration with RWA can help investors better navigate the tech landscape. Here are some notable use cases:

- Real Estate Tokenization: Chainlink can securely link smart contracts with real estate values, allowing for the fractional ownership of properties.

- Commodity Trading: The integration facilitates accurate pricing through reliable data feeds, ensuring fair market value during trades.

- Supply Chain Management: RWA integration helps in tracking and verification, enhancing transparency in the supply chain.

Future Implications of Chainlink RWA Integration

As blockchain technology matures, the implications of integrating Chainlink with RWA will reverberate throughout various sectors. Financial institutions may adopt these technologies to enhance their infrastructure, opening pathways to innovative financial products.

Additionally, as regulatory frameworks evolve, Chainlink’s trustworthy integration may help bridge the gap between traditional finance and decentralized systems, fostering greater collaboration and acceptance.

The Challenges Ahead

While the benefits are abundant, challenges remain in implementing Chainlink RWA integration effectively. Issues such as regulatory compliance, data accuracy, and user trust need addressing. The technology also needs to ensure it withstands various threat vectors synonymous with digital assets.

Conclusion

The integration of Chainlink with Real-World Assets is a tantalizing prospect that promises to enhance security, liquidity, and accessibility within the blockchain space. As the market expands and adapts, Chainlink is poised to play a crucial role in providing the necessary infrastructure to support this evolution.

For the Vietnamese market, this integration represents a significant opportunity for growth, with a notable increase in crypto adoption. As we continue to explore this exciting intersection of DeFi and RWA, Chainlink remains at the forefront, providing valuable insight and robust solutions. Stay tuned to cryptohubble for the latest updates and insights into the evolving landscape of blockchain technologies and their integration with real-world assets.

By John Doe, a blockchain specialist with over 10 years of experience in the crypto industry, having published 15 research papers on blockchain scalability, and served as a lead auditor for multiple high-profile projects.