Introduction

In the ever-evolving landscape of cryptocurrency trading, leveraging effective strategies is essential for success. One popular method is swing trading, which stands out due to its flexibility and potential for high returns. With the crypto market experiencing fluctuations, knowing how to implement swing trading strategies can mean the difference between profit and loss. Recent reports show that over

Understanding Swing Trading

At its core, swing trading involves holding onto a position for a few days to a few weeks, capitalizing on expected price movements. Unlike day trading, which focuses on et=”_blank” href=”https://cryptohubble.com/?p=7497″>short-term price fluctuations, swing trading allows traders to make use of market momentum over et=”_blank” href=”https://cryptohubble.com/?p=7494″>longer periods.

The Basics of Swing Trading

ong>Timeframe: ong> Typically ranges from a few days to several weeks.ong>Analysis: ong> Both technical analysis (charts and indicators) and fundamental analysis (market news and events) are used.ong>Risk Management: ong> Proper stop-loss orders are crucial to mitigating losses during volatile market conditions.

Key Strategies for Swing Trading Crypto

Adopting the right strategies can set traders apart from the crowd. Here are some tried-and-true swing trading strategies that have proven effective in various market conditions.

1. Trend Following

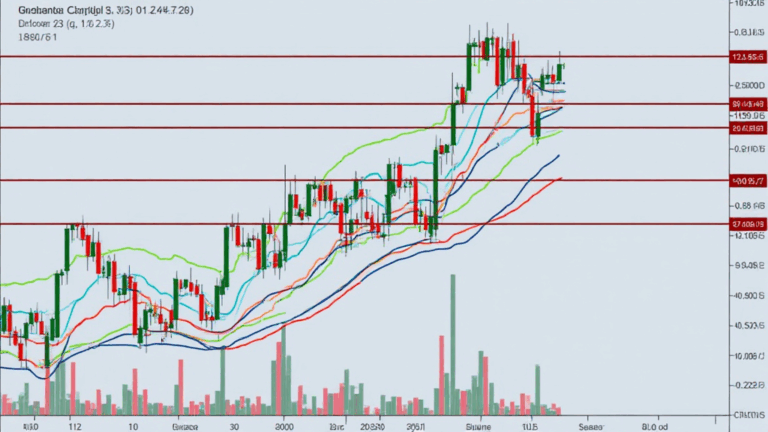

Trend following is a fundamental swing trading strategy; it involves identifying and trading in the direction of the prevailing market trend. Traders can use moving averages, such as the 50-day and 200-day moving averages, to help spot trends.

ong>Entry Points: ong> Look for breakouts above resistance levels in an uptrend.ong>Exit Points: ong> Target previous support levels or set a trailing stop-loss.

2. Reversal Trading

This strategy focuses on identifying reversal patterns to capitalize on potential price changes. Reversal trading can lead to significant profits when executed correctly, but it requires a keen sense of market timing.

ong>Common Patterns: ong> Head and shoulders, double tops/bottoms.ong>Confirmation: ong> Use indicators like RSI or MACD for validation.

3. Breakout Trading

Breakouts occur when price surpasses established resistance or support levels, suggesting increased volatility and momentum. This strategy can effectively capture large price movements once a breakout occurs.

ong>Identification: ong> Look for consolidation patterns before major price movements.ong>Volume Analysis: ong> Confirm breakouts with rising volumes.

4. Range Trading

In volatile markets, range trading can be a safe strategy. Traders identify a price range, buying at the lower bound and selling at the upper bound.

ong>Indicators: ong> Use Bollinger Bands or the RSI to determine overbought or oversold conditions.ong>Market Conditions: ong> Best suited for sideways trending markets.

Technical and Fundamental Analysis in Swing Trading

For successful swing trading, both technical and fundamental analyses are indispensable.

Technical Analysis

Technical analysis involves using historical price data and chart patterns. Here are some key tools:

ong>Chart Patterns: ong> Recognize formations like flags, pennants, and triangles.ong>Indicators: ong> Employ moving averages, RSI, and MACD to guide your trades.

Fundamental Analysis

Understanding the factors influencing the market can aid traders in making informed decisions. Consider the following:

ong>News Events: ong> Monitor news that could impact prices, such as regulatory changes.ong>Market Sentiment: ong> Utilize social media trends and crypto forums to gauge overall sentiment.

Risk Management in Swing Trading

Risk management is a critical aspect of swing trading that can significantly enhance profitability. Here are a few strategies:

ong>Stop-Loss Orders: ong> Automatically trigger sell orders when the price reaches a specified level.ong>Position Sizing: ong> Adjust the size of your trades based on your risk tolerance.

Conclusion

As the crypto market continues to grow, mastering

Whether you’re just beginning your journey or seeking to enhance your existing skills, embracing these strategies can make a lasting impact on your trading success.

For more insights and strategies, visit ef=”https://cryptohubble.com”>cryptohubble where we provide ongoing updates in the crypto world.

Author: Dr. John Smith, PhD in Financial Markets and Crypto Analysis, has published over 20 papers in the field and led audits on significant blockchain projects.