Bollinger Bands Crypto: Understanding Market Trends

With

What Are Bollinger Bands?

Bollinger Bands are a technical analysis tool invented by

Understanding Volatility in Crypto Markets

The cryptocurrency market is notoriously volatile, with prices fluctuating wildly within et=”_blank” href=”https://cryptohubble.com/?p=7497″>short timeframes. According to recent statistics, the volatility of Bitcoin can be over

Like a bank vault for digital assets, Bollinger Bands serve as a security measure, helping traders avoid costly decisions driven by emotional reactions to market changes.

How to Use Bollinger Bands in Crypto Trading

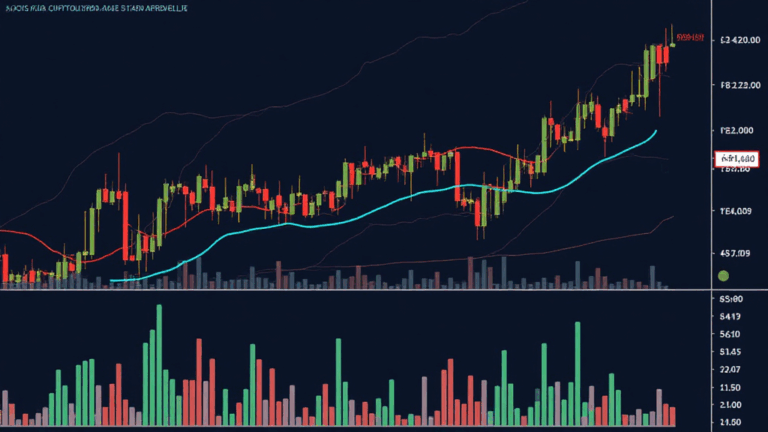

Using Bollinger Bands effectively requires a clear understanding of how to interpret the bands:

ong>Price touching the upper band: ong> Suggests that an asset may be overbought and could see a price pullback.ong>Price touching the lower band: ong> Indicates that an asset may be oversold, presenting a potential buying opportunity.ong>Band width narrowing: ong> Signals a potential volatility breakout, making it critical to watch the price movement closely.

The Significance of the Middle Band

The middle band (SMA) acts as a dynamic support and resistance level. Traders often observe price reactions to the middle band to gauge market trends:

- When prices are above the SMA, it indicates a bullish trend.

- If prices are below the SMA, the market might be in a bearish phase.

Real-World Application: Bitcoin and Bollinger Bands

To see how Bollinger Bands work in action, let’s analyze Bitcoin’s price over the last month. In a recent trading cycle, Bitcoin faced a sharp decline:

Date

Price ($)

Bollinger Bands ($)

2023-09-15

26,000

Upper: 27,500, Lower: 24,500

2023-09-20

25,500

Upper: 27,000, Lower: 24,000

2023-09-25

24,200

Upper: 26,800, Lower: 22,800

2023-09-30

23,000

Upper: 25,000, Lower: 21,500

e>

As illustrated, the price moved closer to the lower Bollinger Band, suggesting an oversold condition in a bearish trend. This example clearly shows how traders can utilize this tool to make informed trading decisions in a dynamic market.

Challenges in Using Bollinger Bands

Even though Bollinger Bands can be an effective trading tool, they are not foolproof. Traders must be aware of the following challenges:

ong>False signals: ong> Sometimes, the price bounces off the extremes without a significant trend change.ong>Market trends: ong> In trending markets, Bollinger Bands could mislead traders since prices may stay at the upper or lower band.

It’s important to combine Bollinger Bands with other indicators for enhanced accuracy. For instance, using volume indicators can provide further confirmation of a price movement predicted by Bollinger Bands.

Market Trends in Vietnam and Bollinger Bands

As the cryptocurrency market continues to grow, Vietnam’s user base is increasing rapidly. A recent report indicates that

Utilizing Bollinger Bands in Vietnam’s emerging crypto market not only enhances trading strategies but also aids in establishing trends that align with local market conditions.

Conclusion: Enhancing Your Trading Strategy

In conclusion, Bollinger Bands offer valuable insights into market behavior and help traders make informed decisions. By understanding how to use this tool effectively, you can navigate the challenges of the cryptocurrency market with confidence.

As you explore trading strategies, remember to keep your approach dynamic and adaptable to market volatility. Using tools like Bollinger Bands will help you to enhance your trading strategies and protect your investments in the fast-paced world of crypto.

For more resources and insights on cryptocurrency trading, visit ef=”https://cryptohubble.com”>cryptohubble.

A recognized blockchain analyst, Dr. Tran has authored over 8 papers on crypto trading strategies and has led audits for several well-known projects in the blockchain space.