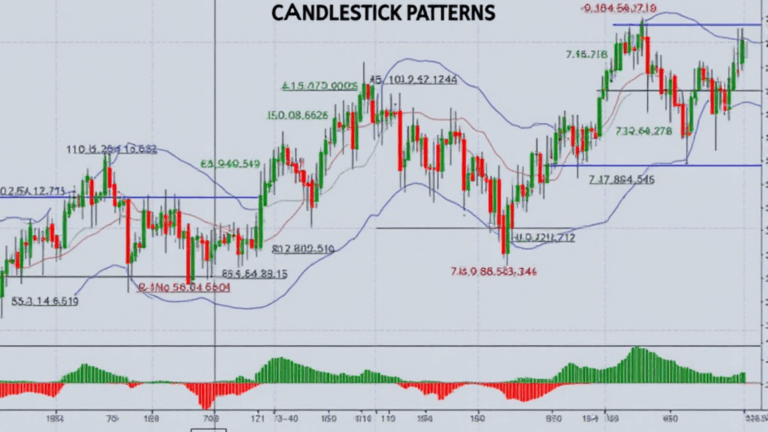

Introduction to Candlestick Patterns

In the ever-evolving world of cryptocurrency, understanding market movements is paramount for any trader. With

As we delve into this comprehensive guide, we will explore the nuances of candlestick patterns in crypto trading, with particular attention to their significance for investors looking to capitalize on market fluctuations. This article will equip you with the knowledge needed to interpret these patterns effectively and make informed trading decisions.

What Are Candlestick Patterns?

Candlestick charts are a popular tool used by traders to gauge market sentiment. Each candle represents a specific time period and provides information on the opening, closing, high, and low prices during that time frame. Here’s a simple breakdown of a typical candlestick:

ong>Body: ong> The thick part of the candlestick represents the opening and closing prices.ong>Wicks: ong> The lines extending from the body show the highest and lowest prices during that period.

There are several types of candlestick patterns, each conveying different market sentiments. Whether it’s a bullish or bearish trend, these patterns serve as crucial indicators for traders.

Types of Candlestick Patterns

Candlestick patterns can be categorized into two main types: single candlestick patterns and multi-candlestick patterns. Let’s dive deeper into some of the most common patterns used in cryptocurrency trading:

Single Candlestick Patterns

ong>Doji: ong> This pattern, characterized by a very small body and et=”_blank” href=”https://cryptohubble.com/?p=7494″>long wicks, indicates market indecision. Traders often view a Doji as a potential reversal signal.ong>Hammer: ong> A hammer forms after a price decline and typically signals a bullish reversal. Its et=”_blank” href=”https://cryptohubble.com/?p=7494″>long lower wick indicates buying pressure.ong>Shooting Star: ong> This pattern appears after a price advance and suggests a potential bearish reversal. The et=”_blank” href=”https://cryptohubble.com/?p=7494″>long upper wick demonstrates selling pressure.

Multi-Candlestick Patterns

ong>Engulfing Patterns: ong> This occurs when a small candle is engulfed by a larger one. A bullish engulfing pattern suggests that buyers have taken control, while a bearish engulfing indicates a shift toward selling pressure.ong>Morning Star: ong> A three-candle pattern signaling a potential bullish reversal, it consists of a bearish candle followed by a small body candle and a strong bullish candle.ong>Evening Star: ong> This is the opposite of the Morning Star and indicates a bearish reversal. It starts with a bullish candle, followed by a small body candle, and ends with a strong bearish candle.

Applying Candlestick Patterns in Crypto Trading

Understanding candlestick patterns is one thing, but applying them effectively in trading strategies is another. Here’s how you can leverage candlestick analysis in your trading:

ong>Combine with Other Indicators: ong> While candlestick patterns provide valuable insights, combining them with other technical indicators, such as moving averages or RSI (Relative Strength Index), enhances their reliability.ong>Identify Support and Resistance Levels: ong> Candlestick patterns work best when identified near significant support and resistance levels. This combination can yield stronger signals.ong>Set Clear Entry and Exit Points: ong> Establish clear entry and exit strategies based on the patterns you identify. This disciplined approach minimizes risks and improves your chances of success.

Candlestick Patterns in the Vietnamese Crypto Market

As markets continue to evolve, the Vietnamese crypto scene is rapidly growing. According to recent studies, Vietnam’s crypto market has seen an impressive

For Vietnamese traders looking to navigate this volatile market, understanding candlestick patterns is crucial. As the local community flourishes, the need for robust trading strategies becomes even more apparent. This presents an exciting opportunity to utilize candlestick analysis to make informed trading decisions.

Conclusion: Mastering Candlestick Patterns

In conclusion, mastering candlestick patterns can significantly enhance your trading strategy in the cryptocurrency market. With the right tools and knowledge, traders can effectively interpret market movements and make informed decisions.

Whether you are new to trading or a seasoned investor, incorporating candlestick analysis into your strategy could provide you with a competitive edge. As the Vietnamese crypto market continues to thrive, being savvy with candlestick patterns is essential for success.

Remember, always stay updated on the latest market trends and continue honing your skills in technical analysis. Investing in cryptocurrencies is not just about understanding the technology; it’s also about making strategic, informed decisions that could lead to profitable outcomes. Always consult local regulations before making financial moves.

For more information on trading strategies and market analysis, visit ef=’https://hibt.com’>hibt.com.

For additional resources, you might want to read our article on ef=’https://hibt.com/vietnam-crypto-tax-guide‘>Vietnam’s crypto tax guide.

Stay informed and keep learning. Happy trading!