Understanding the Crypto Fear and Greed Index

In the ever-fluctuating world of cryptocurrencies, deciding when to buy or sell can be a daunting task. Over $4.1 billion was lost to decentralized finance (DeFi) hacks in 2024, highlighting the need for informed decision-making in crypto trading. One tool that has become essential for traders is the

What is the Crypto Fear and Greed Index?

The

Why is the Index Important?

Understanding market sentiment is vital because emotions often guide trading decisions more than rational analysis. A high level of greed may indicate that prices are high and a correction might be forthcoming, while extreme fear can suggest buying opportunities for et=”_blank” href=”https://cryptohubble.com/?p=7494″>long-term investors. According to a recent study, 65% of crypto investors have admitted to making impulsive decisions based on market sentiment.

Components of the Fear and Greed Index

The index is calculated using several criteria:

ong>Market Volatility: ong> Measures how much price changes in a et=”_blank” href=”https://cryptohubble.com/?p=7497″>short period.ong>Market Momentum: ong> Focuses on recent gains or losses in asset prices.ong>Social Media Engagement: ong> Looks at community sentiments on platforms like Twitter and Reddit.ong>Surveys: ong> Conducts polls to understand trader behavior.ong>Dominance: ong> Evaluates Bitcoin’s market cap compared to other cryptocurrencies.

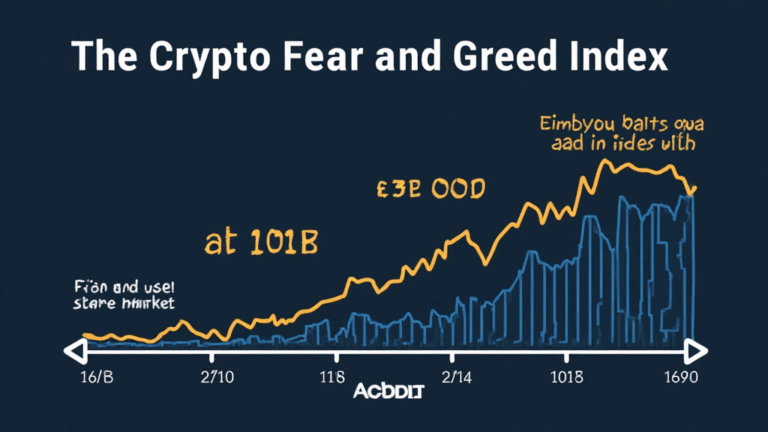

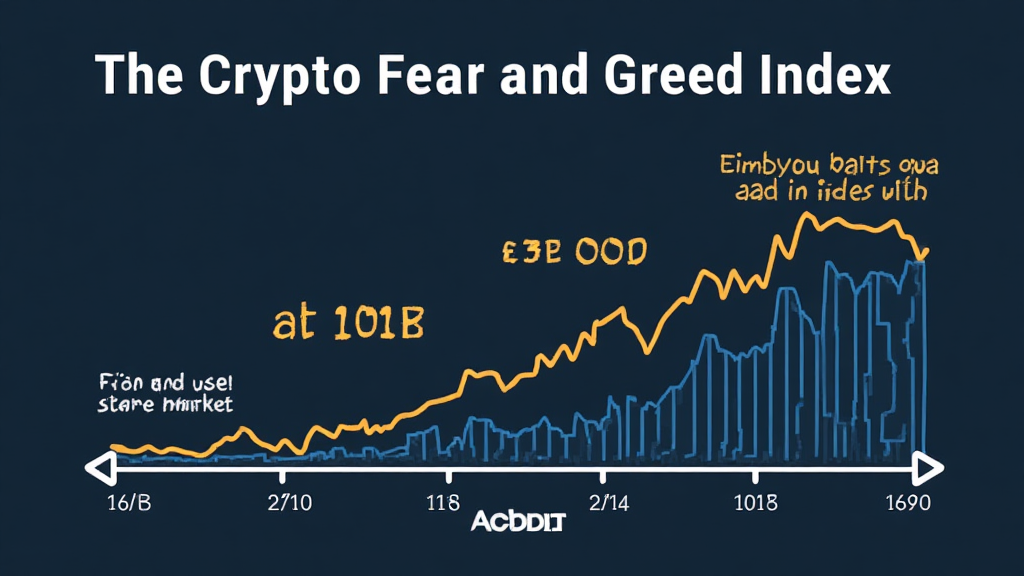

The Index in Action

For instance, during a market correction, if the index shows extreme fear, it might be the right time to invest, similar to a dip in traditional stocks. When examining the trends of the index aet=”_blank” href=”https://cryptohubble.com/?p=7494″>longside Bitcoin prices, research showed that in 2025, purchasing Bitcoin during periods of extreme fear could yield up to a 50% higher return over the following six months.

Real-world Example

In March 2025, the

Understanding Market Trends in Vietnam

Interestingly, Vietnam has seen a significant rise in the interest of cryptocurrencies, with user growth rates approaching 25% annually between 2023 and 2025. This influx shows the relevance of the

Tips for Using the Index for Your Investments

ong>Identify Patterns: ong> Regularly monitor the index to identify patterns that align with historical price movements.ong>Combine with Other Analysis: ong> Utilize technical analysis aet=”_blank” href=”https://cryptohubble.com/?p=7494″>longside the index for a well-rounded view.ong>Stay Informed: ong> Keep an eye on market news and community sentiment that might influence the index.

The Future of the Crypto Fear and Greed Index

As the crypto landscape evolves, so will the

Conclusion

The

For additional resources and tools, check out ef=”https://hibt.com”>hibt.com.