Global Crypto Regulations 2025: Your Essential Guide

As the digital asset landscape evolves, regulations have become a cornerstone for ensuring security and promoting responsible innovation. In 2024 alone, losses from DeFi hacks totaled around $4.1 billion, highlighting the urgent need for clearer global crypto regulations. In this article, we’ll explore what the future holds for the world of cryptocurrency regulations in 2025, and how these developments will impact traders, investors, and platforms like

The Growing Necessity for Regulations

With more than 200 million cryptocurrency users globally, the call for better regulatory frameworks has never been louder. Countries like et=”_blank” href=”https://cryptohubble.com/?p=7017″>Vietnam exhibit robust growth in crypto adoption, with user rates increasing by over

ong>Investor Protection: ong> Regulations help protect investors from scams and fraud.ong>Market Stability: ong> A well-regulated market can foster a more stable investment environment.ong>Encouraging Innovation: ong> Regulations can guide technological advancements while minimizing risks.ong>Global Consistency: ong> Harmonized regulations will facilitate cross-border transactions.

Key Developments in Global Crypto Regulations

As we move toward 2025, several significant regulatory changes are anticipated. Each jurisdiction will approach crypto differently, but common themes have emerged:

The MiCA Regulation in Europe

The Markets in Crypto-Assets (MiCA) regulation is a comprehensive framework proposed by the European Union aimed at regulating crypto-assets across member states. Here are some critical components:

ong>Asset Classification: ong> Crypto-assets will be classified into tokens, e-money tokens, and utility tokens.ong>Licensing Requirements: ong> Companies dealing with crypto will require a license to operate.ong>Consumer Protection: ong> Enhanced mechanisms for protecting consumer rights are a priority.

According to recent reports, MiCA aims to foster innovation while providing clear guidelines for companies, particularly in the

United States Regulatory Landscape

In 2025, the U.S. is expected to embrace more stringent regulations on crypto, including:

ong>SEC Oversight: ong> The Securities and Exchange Commission (SEC) will likely intensify scrutiny of crypto exchanges.ong>Tax Compliance: ong> Mandatory reporting of crypto transactions by exchanges to the IRS.ong>Consumer Safeguards: ong> New initiatives aimed at protecting investors from fraudulent schemes.

Many in the industry are advocating for clearer parameters to facilitate growth while ensuring compliance in this rapidly evolving market.

Spotlight on Asia: Vietnam’s Regulatory Approach

Vietnam has been proactive about crypto regulations. The government has recognized the gap in consumer protection and the necessity for robust frameworks. In 2025, we can expect:

ong>Establishment of Guidelines: ong> Regulatory authorities will introduce formal guidelines for cryptocurrency operations.ong>Taxation Policies: ong> Clear taxation frameworks for crypto transactions will likely emerge.ong>Increased User Education: ong> Initiatives to educate users about risks and opportunities in crypto.

Recently, the Vietnamese government released a draft bill aimed at establishing a regulatory sandbox for blockchain technology enterprises, a positive move toward fostering innovation while ensuring security.

Impact of Regulations on Cryptocurrency Trends in 2025

As regulations tighten globally, we can anticipate several trends that will shape the cryptocurrency landscape:

ong>Rise of Compliance Tools: ong> Companies will invest in tools to ensure compliance, such as legal audit mechanisms for their smart contracts and practices.ong>Emergence of Regulatory-Tech (RegTech): ong> Technologies that assist businesses in understanding and managing compliance will gain popularity.ong>Adoption of CBDCs: ong> Central Bank Digital Currencies (CBDCs) are expected to gain traction as governments look for more control over their monetary systems.

For example,

Navigating Future Regulations

So, how can investors and businesses best navigate these myriad regulations coming in 2025? Here are some practical tips:

ong>Stay Informed: ong> Regularly consult credible sources and updates from local regulatory bodies.ong>Engage with Experts: ong> Seek advice from legal experts who specialize in crypto regulations.ong>Utilize Compliance Tools: ong> Leverage platforms and tools designed to assist with compliance issues.

Staying ahead of the regulatory curve can be the difference between thriving and merely surviving in the blockchain ecosystem.

Conclusion: Preparing for a Regulated Future

In conclusion, the landscape of global crypto regulations in 2025 is gearing up to be more structured and, therefore, more inviting for responsible investment. Investors and platforms must adopt a proactive stance regarding regulatory compliance and security measures. By embracing compliance, entities can create a safer and more transparent market for everyone.

To wrap it up, 2025 is set to be a pivotal year for cryptocurrency regulations. Investors should prepare to adapt to these changes while recognizing the potential opportunities in a well-regulated environment.

Remember, when dealing with cryptocurrency, always consult local regulators and ensure compliance with existing laws. Not financial advice. Stay informed and secure your investments wisely.

Explore more insights and tools at ef=”https://www.cryptohubble.com”>Cryptohubble.

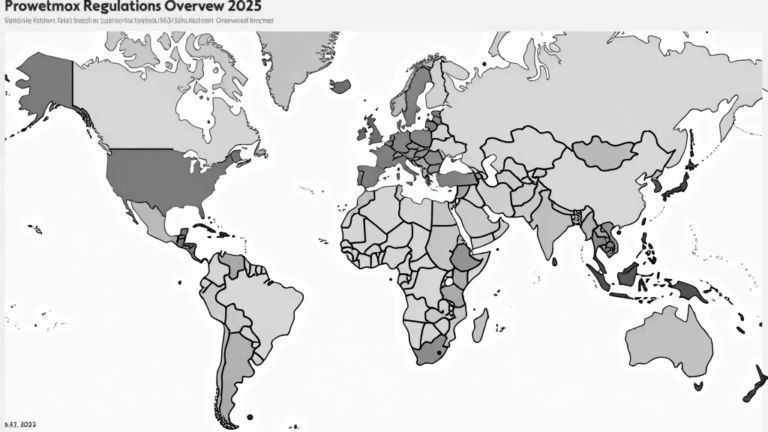

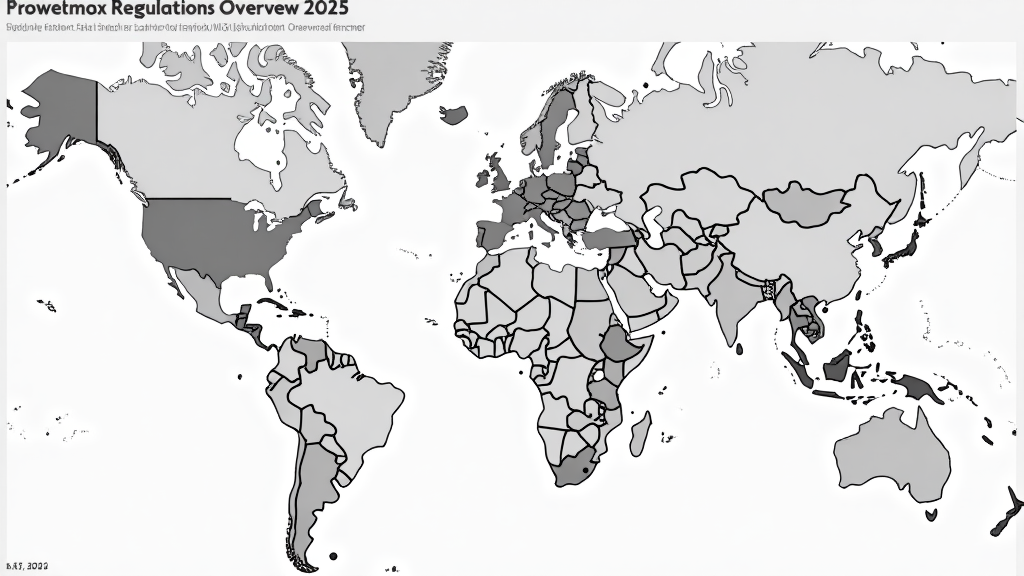

egulations 2025 overview chart” src=”crypto_regulations_2025.png” />