Introduction

The cryptocurrency landscape has evolved dramatically over the past few years, with derivatives products leading the way in providing traders with innovative strategies and risk management tools. In 2024 alone, the market saw an influx of over $4.1 billion lost to DeFi hacks, underscoring the essential need for secure trading environments. This is where

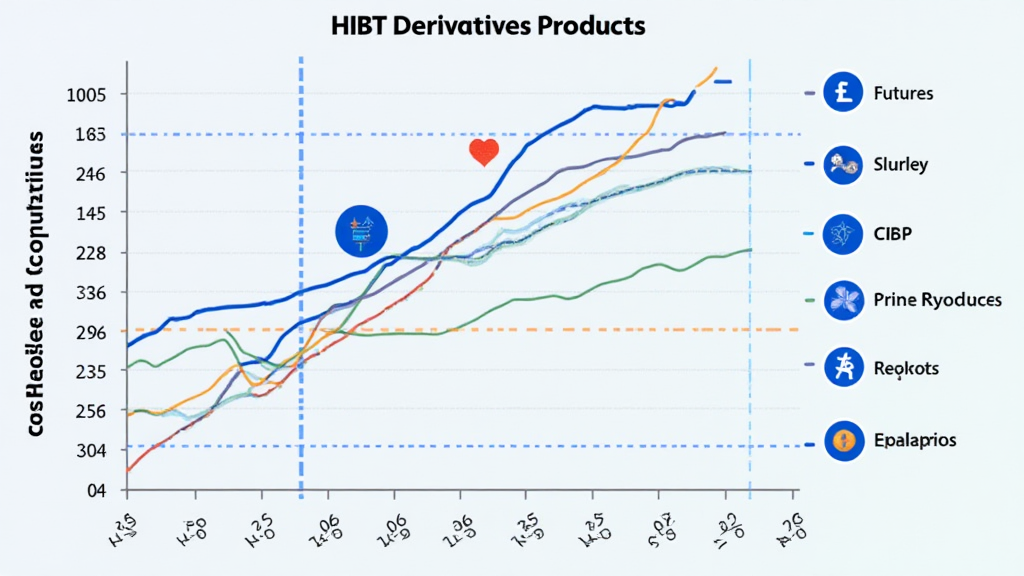

Understanding HiBT Derivatives Products

At its core,

ong>Futures Contracts: ong> Agreements to buy or sell an asset at a predetermined price at a specified time in the future, allowing traders to speculate on price movements.ong>Options Contracts: ong> Provide the holder with the right, but not the obligation, to buy or sell an asset at a certain price before a specified date.ong>CFDs: ong> Enable traders to speculate on the price movements of assets without owning them, making it easier to enter and exit trades based on et=”_blank” href=”https://cryptohubble.com/?p=7497″>short-term market movements.

The Rise of HiBT Derivatives in Vietnam

Recent data indicates that Vietnam’s cryptocurrency user base has expanded rapidly by over 300% in the past year, creating vast opportunities for advanced trading solutions like

The popularity of derivatives trading can be attributed to several factors:

ong>Leverage: ong> Traders can control larger positions with a smaller capital outlay.ong>Risk Management: ong> Effective hedging strategies can be employed to protect against adverse movements in asset prices.ong>Flexibility: ong> Traders can take et=”_blank” href=”https://cryptohubble.com/?p=7494″>long or et=”_blank” href=”https://cryptohubble.com/?p=7497″>short positions, allowing them to profit in both rising and falling markets.

With the Vietnamese market booming, platforms like ef=’https://hibt.com’>hibt.com are becoming increasingly essential in facilitating these trading strategies.

Security Standards for Crypto Derivatives

As more traders engage with

In this context, it’s crucial to consider:

ong>Smart Contract Audits: ong> Ensuring the integrity of the smart contracts that govern derivatives trading.ong>Cold Storage Solutions: ong> Storing user funds in secure, offline wallets to guard against hacks.ong>Regulatory Compliance: ong> Adhering to local laws and regulations to build trust with users, especially in jurisdictions like Vietnam where regulatory landscapes are evolving.

By following these standards, platforms can significantly mitigate risks while promoting the safe adoption of

Maximizing Trading Strategies with HiBT Derivatives

To effectively utilize

ong>Hedging: ong> Protecting existing investments by taking offsetting positions in derivatives.ong>Speculation: ong> Taking leveraged positions based on anticipated market movements to maximize profit potentials.ong>Portfolio Diversification: ong> Incorporating derivatives to create a more balanced and resilient investment portfolio.

For instance, using futures contracts can be likened to a farmer locking in the price of their crop before harvest. In doing so, they mitigate the risk of price fluctuations, much like a trader might hedge their crypto investments using derivatives.

Challenges and Considerations in Derivatives Trading

Despite the potential advantages of engaging with

ong>Market Volatility: ong> Cryptocurrencies are notoriously volatile, which can lead to significant losses if trades are not monitored closely.ong>Complexity: ong> The mechanics of derivatives can be daunting for new traders, necessitating a solid understanding before participation.ong>Emotional Trading: ong> The high stakes involved in derivatives trading can lead to emotional decision-making, often leading to unfavorable outcomes.

To mitigate these issues, traders are encouraged to utilize tools such as portfolio analytics, real-time data feeds, and trading bots that can automate strategies and minimize emotional responses to market changes.

Conclusion

In conclusion,

**Remember to consult with local regulatory authorities and the necessary financial professionals before making any investment decisions.**