Navigating HiBT KYC Vietnam: Ensuring Your Crypto Safety

In a world where cryptocurrency theft and fraud can destabilize entire households, understanding the implications of Know Your Customer (KYC) protocols is essential. By 2024, there was an estimated loss of $4.1 billion to DeFi hacks, emphasizing the dire need for robust compliance frameworks. Vietnam, with its rapidly growing crypto market, is no exception. This article discusses HiBT KYC standards in Vietnam and their significance in enhancing security measures for digital assets.

What Is HiBT KYC?

HiBT KYC, or Get Your KYC Process Right, is pivotal for any cryptocurrency platform, including those operating in Vietnam. KYC is a process to verify customers’ identities before they can participate in transactions. It aims to ensure that services are not used for illicit activities like money laundering or fraud.

The Importance of KYC in Vietnam

- Growing Crypto Adoption: Vietnam has experienced a 29% increase in users engaging with cryptocurrencies from 2020 to 2023.

- Regulatory Compliance: Following the Financial Action Task Force’s (FATF) guidelines, KYC helps to mitigate risks.

- Building Trust: Compliance promotes trust among users, essential for fostering a sustainable digital economy.

Challenges in Implementing HiBT KYC in Vietnam

Although the importance of KYC is acknowledged, several hurdles exist:

- Infrastructure Limitations: Many platforms struggle to establish robust infrastructures to handle KYC requirements efficiently.

- User Privacy Concerns: Many users fear that sharing personal information may lead to identity theft.

- Regulatory Environment: Rapidly changing regulations can complicate compliance efforts.

Similarities with Traditional Banking Security

Think of KYC processes as a bank vault that safeguards your assets. Just as banks require documentation to open an account, cryptocurrency platforms like HiBT mandate identity verification to protect users. It’s an evolving landscape, much like the banking industry did during the initial rise of online banking a few decades back.

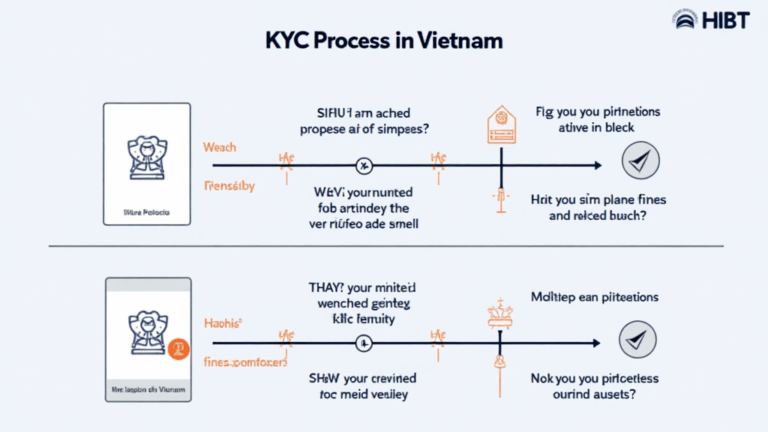

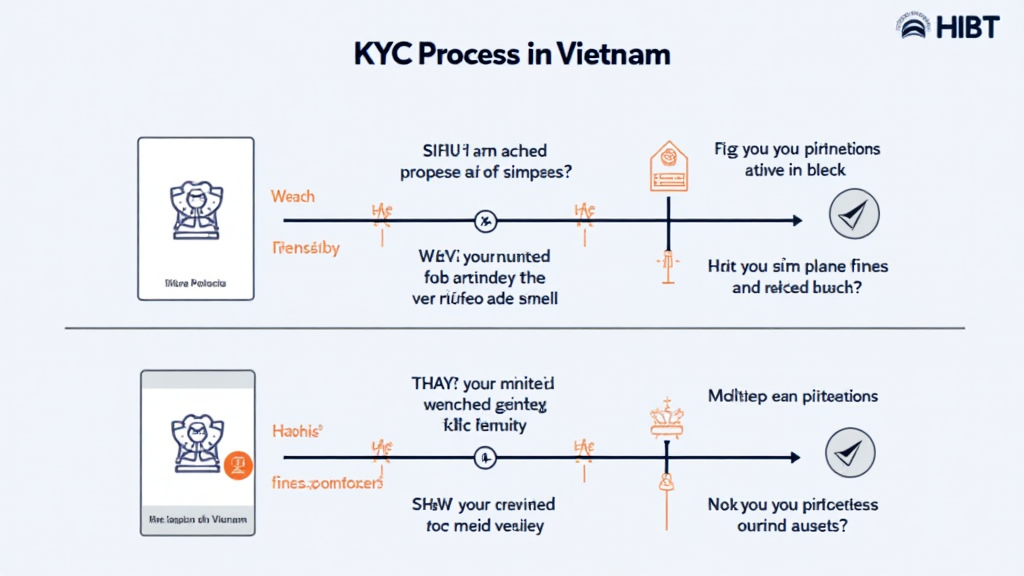

Key Components of HiBT KYC

The HiBT KYC framework comprises several steps aimed at optimizing security:

- Identity Verification: Users must provide government-issued identification.

- Address Verification: Utility bills or bank statements can be used to confirm users’ addresses.

- Risk Assessment: The platform may assess the risk levels associated with transactions.

Real-World Application Data

According to Chainalysis 2025 report, Vietnam holds a significant portion of the Southeast Asian crypto market, commanding nearly 25% of the trading volume. This highlights the urgency for stringent KYC procedures within local platforms like HiBT.

How Users Can Protect Their Cryptocurrencies

While the KYC process provides essential layers of security, users must also take proactive steps:

- Enable Two-Factor Authentication: Always activate 2FA on your accounts for an added protective layer.

- Use Hardware Wallets: Devices like Ledger Nano X significantly reduce the risk of hacks by keeping your private keys offline.

- Stay Informed: Keep yourself updated on the latest scams and security practices within the cryptocurrency space.

Conclusion: Embracing the Future of Crypto Safety in Vietnam

With increasing adoption among Vietnamese users, the HiBT KYC framework is critical in ensuring their digital assets are secure. Compliance with such standards doesn’t just serve the individual; it helps maintain the integrity of the entire crypto ecosystem. Markets like Vietnam, increasingly becoming crypto hubs, must prioritize these mechanisms to safeguard their burgeoning investments in the industry.

For more information about KYC practices, visit HiBT.

By adopting these standards, players in the Vietnamese crypto market position themselves not just for compliance but for lasting trust and security within the decentralized world.

Authored by Dr. Minh Nguyen, a recognized blockchain analyst with over fifteen publications in the field of cybersecurity, specializing in the audits of leading cryptocurrency platforms.