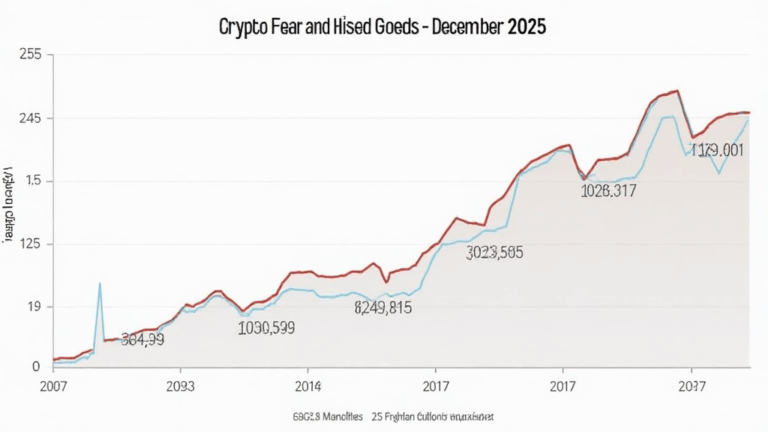

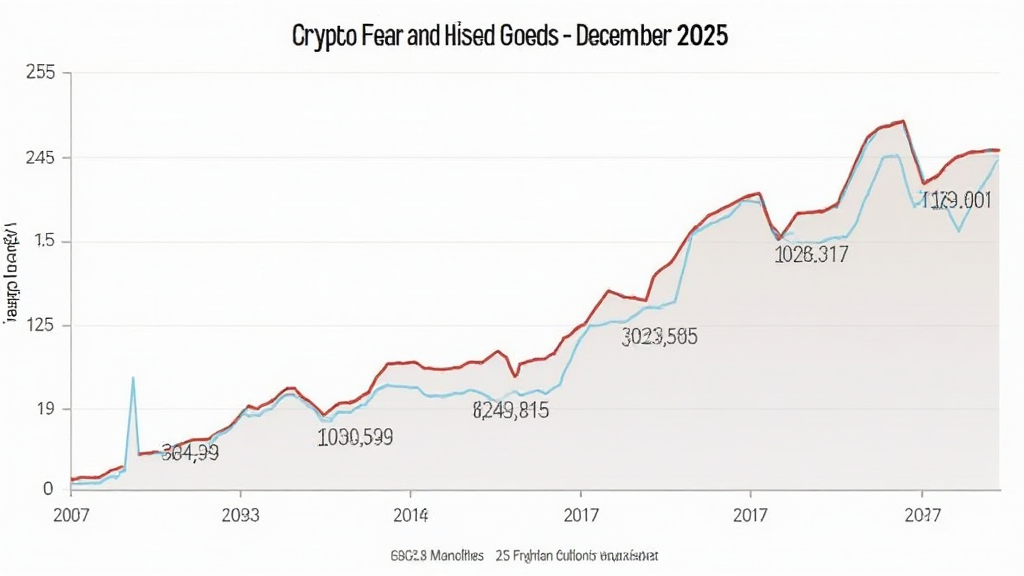

Crypto Fear and Greed Index December 2025: Understanding Market Sentiment

As we step into December 2025, the crypto market is at a pivotal moment characterized by volatility and investor sentiment. The crypto fear and greed index is a key tool that helps investors gauge the psychological state of the market. According to recent reports, psychological factors are increasingly influencing market behavior, with fears of a downturn looming. In this article, we’ll explore the current state of the crypto market, delve into the fear and greed index, and discuss its implications for investors looking to navigate this dynamic landscape.

The Essence of the Crypto Fear and Greed Index

The crypto fear and greed index is a composite measure that utilizes several factors to assess market sentiment. From historical price movements to trading volume, social media interactions, and Google Trends, this index provides a snapshot of whether investors are feeling fearful or greedy.

As of December 2025, the index reflects a growing sense of fear among investors, largely driven by market fluctuations and external economic pressures. With inflation rates affecting traditional markets, investors are seeking stability, leading to cautious optimism in some quarters.

How is the Index Calculated?

- Market Volatility: Measures the price fluctuations of cryptocurrencies over specific time frames.

- Market Momentum: Analyzes changes in trading volume and market capitalization.

- Social Sentiment: Evaluates sentiments expressed on social media platforms regarding cryptocurrencies.

- Search Trends: Examines search volumes for keywords related to cryptocurrency in Google Trends.

This multifaceted approach ensures that the index provides a comprehensive overview of market sentiment. For instance, in early December 2025, the index indicated a fear level of 40 out of 100, suggesting that while investors are cautious, there is still room for potential growth.

Market Dynamics: The State of Cryptocurrencies in December 2025

In analyzing the crypto market dynamics as we approach December 2025, it is crucial to consider external factors affecting investor confidence. With the emergence of new regulations around the world, particularly in Southeast Asia, markets have faced both challenges and opportunities.

Growth Trends in the Vietnamese Market

Vietnam’s cryptocurrency market has shown remarkable resilience. According to recent statistics, the user growth rate in Vietnam has surged by over 30% in 2025, indicating a robust adoption of cryptocurrencies among the populace. This growth is supported by a favorable regulatory environment and increased technological access.

Local investors are particularly keen on exploring emerging altcoins and blockchain technologies that promise high returns. This aligns with global trends where alternative investment opportunities continue to expand.

Investment Strategies Amidst Fear and Greed

For investors, understanding the fear and greed index is pivotal in formulating a sound investment strategy. In a climate where emotions can lead to rash decisions, informed trading practices are essential.

Evaluating Risk and Exploiting Opportunities

- Diversification: Spread investments across various cryptocurrencies to mitigate risks associated with market volatility.

- Long-term Holding: Consider holding assets for extended periods, especially when fear is prevalent. History shows that markets tend to rebound.

- Staying Informed: Regularly track sentiment indicators and markets’ performance to make data-driven decisions.

With the fear level at an all-time high, now might be the right moment for investors to consider undervalued assets. Remember, significant opportunities often lie in adverse conditions.

Conclusion: Navigating Between Fear and Greed in December 2025

As December 2025 unfolds, the crypto fear and greed index remains a critical barometer for investor sentiment. As emotions run high, it is vital to adopt an informed approach towards investments. Whether the market swings towards greed or is ensnared by fear, awareness of these shifts can be leveraged to your advantage.

Overall, while the future of cryptocurrencies remains uncertain, investors armed with knowledge and understanding of sentiment indicators like the fear and greed index are better positioned to navigate the complexities of the digital asset landscape.

As you explore investment options, always ensure to conduct thorough research and consider local regulations pertinent to investment processes.

For further insights into navigating the world of cryptocurrencies, explore more at hibt.com.