Investing in Indonesia’s Crypto: A Comprehensive Guide

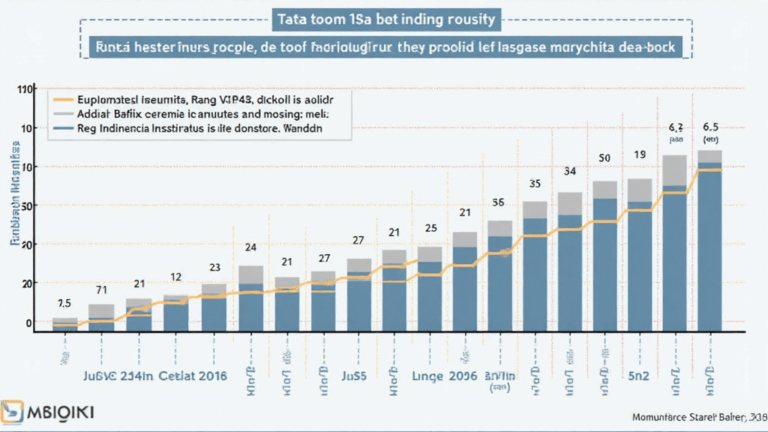

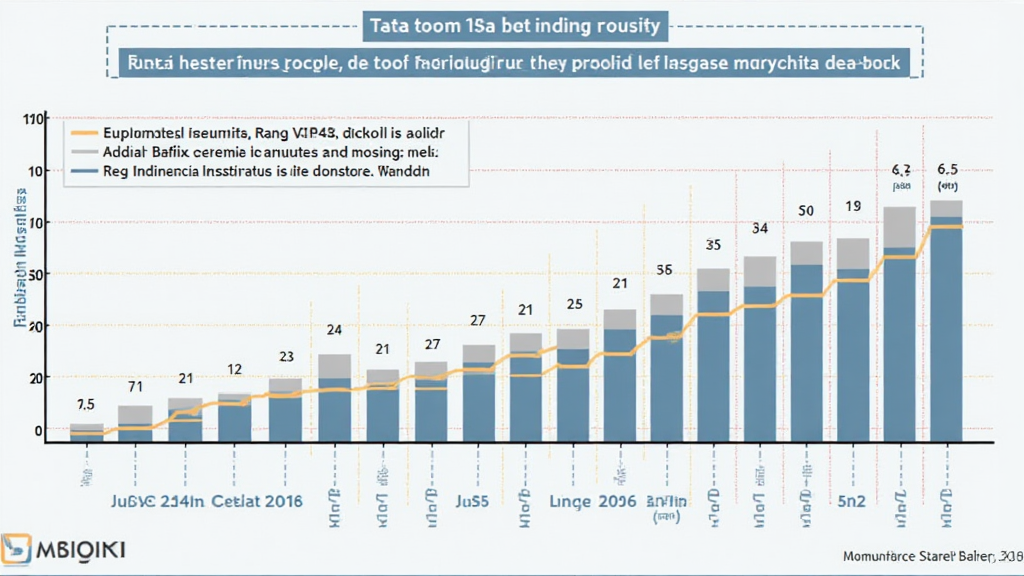

As the global cryptocurrency market evolves, Indonesia is rapidly emerging as a key player in the region. The popularity of crypto investments in Indonesia has skyrocketed, with a reported 3.7 million crypto investors by 2023. This surge prompts the need for a thorough understanding of crypto investments in Indonesia, including regulations, strategies for success, and growth opportunities.

1. The Rise of Cryptocurrency in Indonesia

With rising internet penetration and mobile usage, Indonesia is perfectly positioned for cryptocurrency boom. According to recent data, there has been a 25% increase in crypto ownership among Indonesians year-on-year. Much like how mobile banking transformed the financial services industry, cryptocurrency is poised to reshuffle investment landscapes.

ong>Internet Penetration: ong> As of 2023, over 70% of Indonesians are active internet users.ong>Investment Mindset: ong> There has been a cultural shift towards embracing alternative investments in the younger demographic.ong>Government Support: ong> The Indonesian government is considering regulatory frameworks that bolster cryptocurrencies.

2. Understanding the Legal Landscape

Regulatory frameworks surrounding cryptocurrencies in Indonesia have evolved significantly. The Financial Futures Exchange (BBJ) and the Commodity Futures Trading Regulatory Agency (BAPPEBTI) oversee crypto trading. However, a thorough understanding of the laws is crucial to mitigate risks.

ong>Registration Requirements: ong> All crypto exchanges must register with BAPPEBTI to operate legally.ong>Taxation: ong> Crypto transactions are subject to tax, and users must comply with local tax laws.ong>Investor Protection: ong> Regulations are regularly updated to enhance consumer protection in crypto trading.

3. Popular Cryptocurrencies Among Indonesian Investors

Following the global trend, various cryptocurrencies are gaining traction among Indonesian investors. Here are some popular options:

ong>Bitcoin: ong> The leading cryptocurrency continues to dominate investment portfolios.ong>Ethereum: ong> Known for its smart contract capabilities, Ethereum is also widely invested in.ong>Local Altcoins: ong> Unique Indonesian tokens are beginning to emerge, appealing to local buyers.

4. Investment Strategies for Success

Successful investing in cryptocurrencies requires a strategic approach:

ong>Diversification: ong> Just like a balanced portfolio, don‘t put all eggs in one basket.ong>Staying Informed: ong> Follow updates on regulations and market trends.ong>Long-Term Perspective: ong> Crypto can be volatile; having patience is key.

5. The Future of Crypto Investments in Indonesia

As we look ahead, projections suggest that by 2025, the number of crypto investors in Indonesia could double, fueled by ongoing education and awareness of digital assets. With young, tech-savvy individuals taking an interest in the crypto space, there’s tremendous potential for growth.

ong>Market Trends: ong> Stay tuned for evolving trends and emerging technologies.ong>Increased Adoption: ong> Ongoing education will lead to greater acceptance of crypto in everyday transactions.ong>Regulatory Evolution: ong> Continuous improvements in regulations will foster a safer investment environment.

Here‘s the catch: investing in cryptocurrencies can be lucrative, but it comes with its own set of risks. It is crucial to research and understand the market before diving in. Whether you are a seasoned investor or just starting, it’s beneficial to engage with communities that share insights and experiences.

In conclusion, Indonesia’s crypto investment landscape is rich with opportunities and challenges. Understanding the key elements of this market will be crucial for any investor looking to navigate through it successfully. For more related insights, you might want to ef=”https://hibt.com/crytpo-guide” rel=”noopener noreferrer”>check this detailed guide on crypto investments.

Welcome aboard, and happy investing!