Introduction

In the rapidly evolving landscape of cryptocurrency, the quest for passive income has become a focal point for many investors. With over $4.1 billion lost to DeFi hacks in 2024 alone, traditional investment avenues are becoming less appealing. Instead, individuals are turning towards

Understanding Passive Income in Crypto

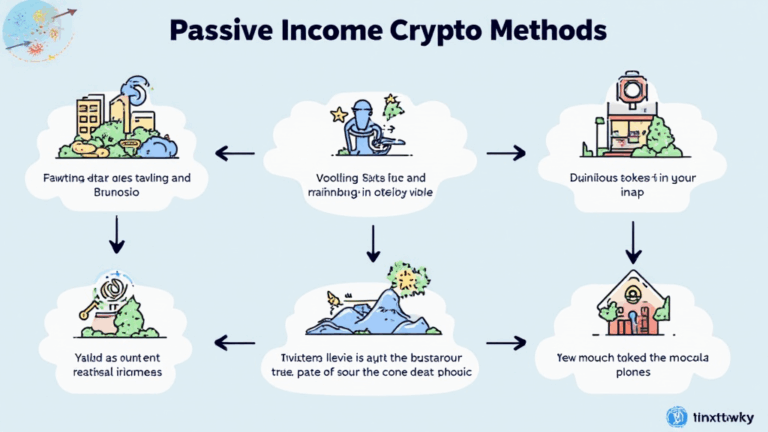

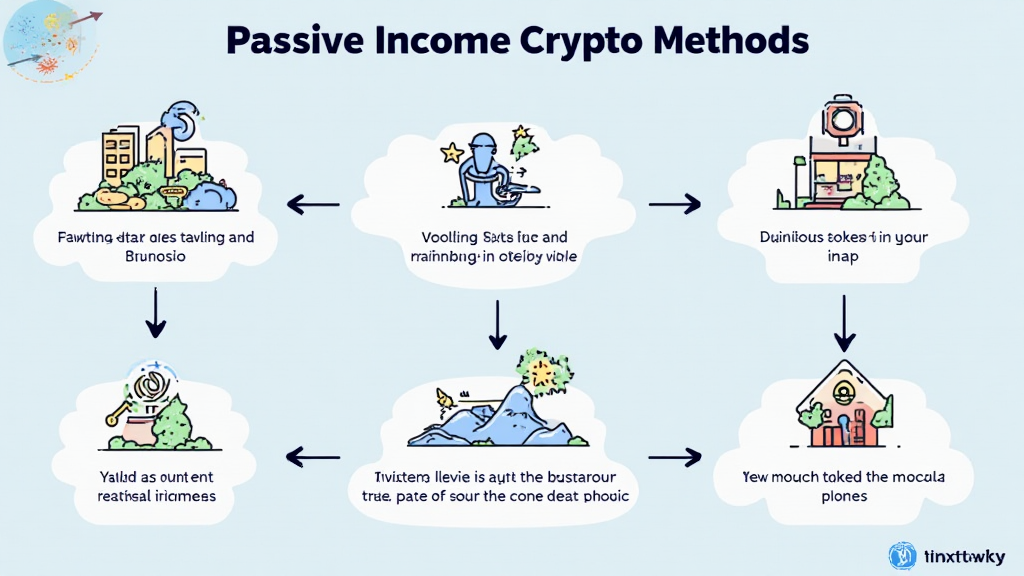

Passive income refers to earnings derived from an investment or venture that requires minimal effort to maintain. In the crypto realm, this can manifest in various forms:

ong>Staking: ong> Individuals can earn rewards by holding coins in a blockchain wallet, contributing to network security.ong>Yield Farming: ong> This involves lending crypto assets to generate high returns, often seen in DeFi platforms.ong>Dividend-Paying Tokens: ong> Some cryptocurrencies distribute dividends to holders, offering a regular income stream.ong>Rental Income from NFTs: ong> Unique digital assets can be rented out on platforms, generating passive revenue.

The Rise of Staking

Staking has gained immense traction, especially with the surge of proof-of-stake (PoS) networks. Here‘s the catch: the process of staking involves locking up your crypto assets for a specific period, which contributes to the security and efficiency of the blockchain. Recent data indicates that staking rewards can yield returns of up to 20% annually, which significantly surpasses traditional savings accounts.

How to Get Started with Staking

1. **Choose a Staking Wallet:** Ensure it is secure and user-friendly. Examples include Ledger and Exodus.

2. **Pick a PoS Coin:** Popular options are Ethereum 2.0, Cardano, and Polkadot.

3. **Understand the Lock-Up Period:** Some coins require you to lock your assets for a defined time.

4. **Join a Staking Pool:** This can help you earn rewards faster by pooling resources with other investors.

Exploring Yield Farming

Yield farming has become a buzzword in the crypto community, attracting attention for its high returns. Like the analogy of farmers planting seeds for growth, yield farming allows investors to lend their assets to borrowers.

ong>Liquidity Provision: ong> Investors provide liquidity to a DeFi platform and earn returns.ong>Liquidity Mining: ong> You can receive additional tokens for providing liquidity.ong>Smart Contract Audits: ong> Always ensure the platform has undergone thorough audits to avoid hacks.

Dividend-Paying Tokens: A Steady Income Source

Some cryptocurrencies distribute a fraction of their profits to holders, mimicking traditional stock dividends. Notable examples include:

ong>Nexo: ong> Offers interest on your crypto holdings.ong>Celo Dollar: ong> Adopts a unique model providing dividends through user engagement.

Moreover, the growing accessibility of cryptocurrency exchange platforms has made these investment opportunities more approachable for the average user.

NFTs and Rental Income

The boom in NFTs has opened a new avenue for passive income. Owners can rent out digital assets, allowing creators to monetize their work further. Imagine owning a piece of digital art—now, you can rent it out and earn income.

ong>Decentraland: ong> Rent virtual land for various events or exhibitions.ong>CryptoVoxels: ong> Owners can showcase art in virtual galleries and charge entry fees.

Vietnam’s Growing Influence in Crypto

The Vietnamese market has seen a dramatic rise in crypto adoption. Recent statistics reveal a 25% growth rate in crypto users within Vietnam in 2024, driven by a burgeoning interest in investments and technology.

This increase emphasizes how passive income crypto methods are becoming increasingly relevant, especially among Vietnam’s youth. As they seek ways to generate additional income streams, understanding these methods can lead to financial freedom.

Wrapping Up Passive Income Crypto Methods

As we delve deeper into the world of cryptocurrencies, passive income methods present an exciting opportunity to build wealth. Whether through staking, yield farming, dividend-paying tokens, or renting NFTs, the landscape is rich with potential. However, it’s essential to conduct thorough research and consult local regulations before diving into these investments.

Remember, not financial advice. Always approach investments with caution and due diligence.

In conclusion,

For more insights into maximizing your crypto investments, check out ef=”https://hibt.com”>hibt.com.

About the Author

Dr. Nguyen Vu, a renowned blockchain analyst, has published over 30 papers in the field and has led prominent audit projects in the cryptocurrency space.