Introduction

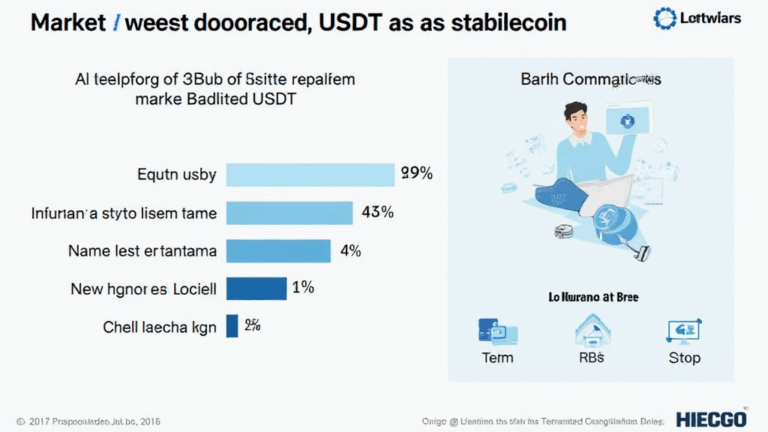

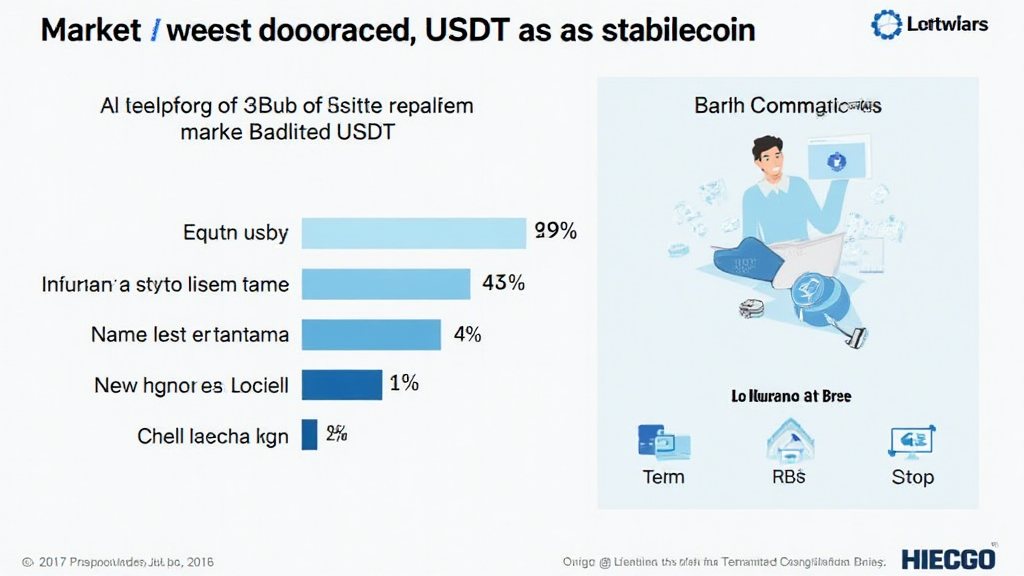

As the cryptocurrency landscape evolves, the dominance of stablecoins has become a focal point for investors and analysts alike. Among these, Tether (USDT) stands out with its significant market dominance, accounting for a substantial portion of the trading volume in the crypto ecosystem. According to recent data, USDT commands over 60% of the stablecoin market share, making it a pivotal cryptocurrency for traders.

In the past year, we have witnessed a surge in adoption from emerging markets, particularly in Vietnam, where the user growth rate for cryptocurrencies hit a remarkable 168% in 2022. This article will explore the various factors contributing to USDT’s market dominance, compare its stability to other cryptocurrencies, and discuss its potential future performance. Let’s break it down.

Understanding the Mechanics of USDT

Tether was launched in 2014 with the intent of bridging the gap between fiat currencies and cryptocurrencies, serving as a stable store of value. It operates on multiple blockchains, including Ethereum and Tron, which enhances its accessibility and liquidity. The core mechanics behind USDT’s stability hinge on its 1:1 peg to the US Dollar, which is maintained through various reserves and operational procedures.

Here’s the catch: the ongoing debates surrounding its transparency and reserve backing have raised questions about USDT’s reliability. However, Tether has consistently provided attestations of its reserves, claiming that each USDT is fully backed by USD or equivalent assets.

The Impact of USDT on the Crypto Market

USDT’s market dominance is not merely a reflection of investor trust but is also influenced by the operational efficiencies it offers. Traders frequently use USDT to hedge against market volatility, especially in times of uncertainty. This has led to USDT encompassing a daily trading volume that often surpasses that of Bitcoin.

ong>Volatility Counteraction: ong> USDT allows traders to mitigate risks associated with crypto price fluctuations.ong>Liquid Trading Options: ong> It facilitates easier entry and exit from positions in a variety of cryptocurrencies.ong>Latent Demand: ong> As more users enter the crypto market, USDT’s demand naturally escalates.

Comparison with Other Stablecoins

While USDT leads the stablecoin market, it’s essential to assess how it stacks up against its competitors like USD Coin (USDC) and Binance USD (BUSD). Each stablecoin aims for the same purpose but has different backing mechanisms and market adoption rates.

For instance, USDC, issued by Circle, has emphasized regulation and transparency. On the other hand, BUSD, backed by Binance, benefits from the trust placed in one of the leading exchanges. Here’s a comparative table summarizing their primary attributes:

ead> ead>

USDT

60%

Moderate

Fiat Reserves

BUSD

15%

Moderate

Fiat Reserves

e>

The Future of USDT Market Dominance

Despite concerns regarding regulatory scrutiny and competition from central bank digital currencies (CBDCs), USDT is positioned to maintain its market dominance through continued innovation and adoption. Emerging markets, especially in Southeast Asia, are likely to see an influx of new users embracing cryptocurrencies.

In Vietnam, for example, increasing smartphone penetration and favorable regulatory developments are anticipated to bolster crypto adoption, further enhancing USDT’s relevance. The projected growth in user adoption indicates a bullish sentiment for the stablecoin, and now is a critical time for market players to understand its future dynamics.

Conclusion

Understanding USDT market dominance is crucial for anyone involved in cryptocurrency trading or investment. Its role as a stablecoin allows it to provide a safety net against market volatility, thereby firmly entrenching its position in the crypto ecosystem. As the market continues to evolve, USDT’s integration with emerging technologies and regional markets will be pivotal in determining its future trajectory.

To navigate the dynamic landscape of cryptocurrencies effectively, it’s essential to stay informed and connected with credible sources. Whether you are a seasoned investor or a newcomer, platforms like ef=”https://cryptohubble.com”>cryptohubble can guide you through the complexities of the crypto market.

**[Expert Author: Dr. Alex Thompson, PhD in Blockchain Technology and Contributor to multiple leading tech journals with expertise in financial audits of blockchain projects. His research focuses on establishing security standards for digital assets.]**