Liquidation Heatmap: Visualize Crypto Market Dynamics

Imagine navigating the complex landscape of cryptocurrency trading, where every second counts, and anxiety over potential losses looms large. With the total market capitalization of cryptocurrencies fluctuating dramatically and new participants entering the ecosystem daily, understanding market dynamics has never been more critical. A staggering

This is where liquidation heatmaps come into play, serving as a visual representation of where significant liquidations might occur. By analyzing these heatmaps, traders can make informed decisions, reduce risks, and potentially capitalize on market inefficiencies. This guide will delve into the intricacies of liquidation heatmaps in the crypto space, offering insights that are not only relevant but essential for both new and seasoned traders.

What is a Liquidation Heatmap?

A liquidation heatmap is essentially a graphical representation of liquidations across various cryptocurrency exchanges. These heatmaps display areas most likely to experience liquidation activity based on existing positions. When the market price of an asset falls below a predetermined level, traders who have used leverage may find themselves facing potential liquidation — this can lead to cascading liquidations and increased market volatility.

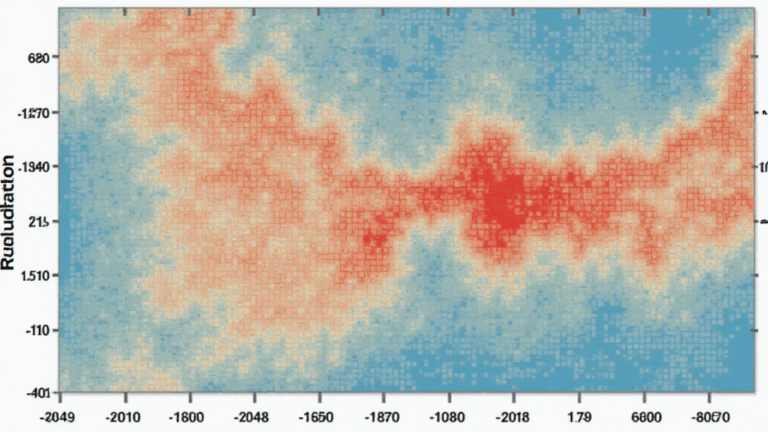

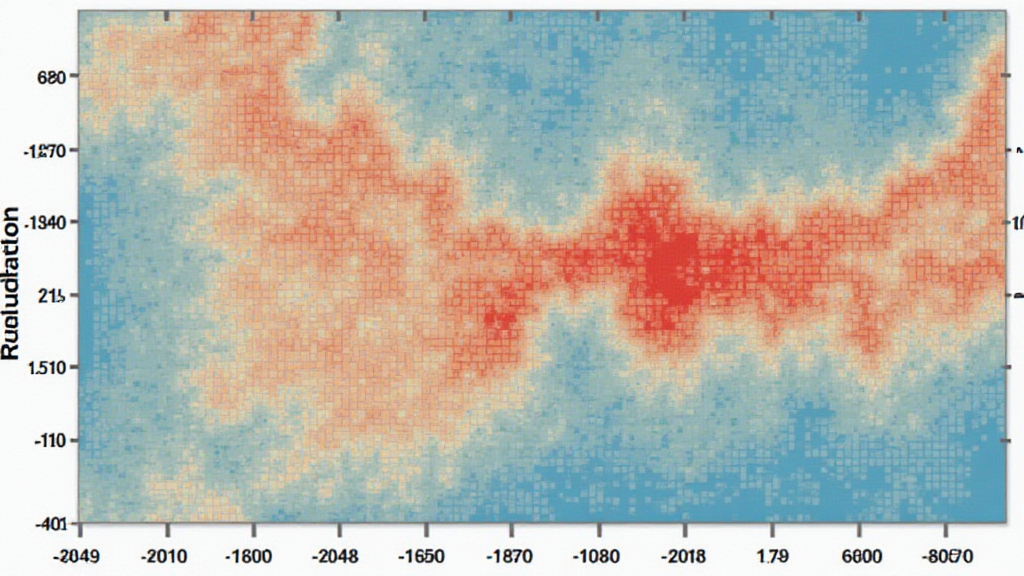

- The heatmap typically uses color gradients, with cooler colors representing low liquidation clusters and warmer tones indicating high-risk areas.

- Visualizing this data enables traders to discover potential support and resistance levels based on where liquidations are likely to occur.

Why Are Liquidation Heatmaps Important?

Understanding why liquidation heatmaps are crucial can be likened to having a weather forecast before heading outdoors. Just as you wouldn’t want to be caught in a storm unprepared, entering the trading arena without insights from a heatmap can expose you to unnecessary risks. Here’s why these tools should be on your radar:

ong>Risk Management: ong> Identifying where liquidations could happen helps traders manage risk more effectively. By avoiding areas with high liquidation potential, traders can protect their investments and avoid significant losses.ong>Market Sentiment: ong> These heatmaps can also reflect market sentiment. Large concentrations of pending liquidations may indicate bullish or bearish trends.ong>Strategic Planning: ong> Traders can use heatmaps to plan entry and exit strategies, adjusting their positions based on potential market movements.

How to Read a Liquidation Heatmap

When analyzing a liquidation heatmap, it’s essential to understand the data being represented. Here’s a straightforward breakdown:

ong>Color Representation: ong> Typically, warm colors (red/orange) signify areas with high risk of liquidation, while cool colors (blue/green) represent safer zones.ong>Volume Indicators: ong> Heatmaps may also incorporate volume indicators, providing insight into the number of positions that might get liquidated as the market fluctuates.ong>Price Levels: ong> The x-axis usually represents price levels, while the y-axis indicates the volume of liquidation scheduled at each price point.

Real-World Application of Liquidation Heatmaps

Let’s break it down with a simple analogy: imagine a bank vault as your cryptocurrency investment — the more you know about potential risks, the better you can secure your assets. Just like determining the safest time to access that vault, liquidation heatmaps guide traders in making transactions at the most opportune moments to maximize their prospects.

User behaviors in the Vietnamese crypto market have shown consistent growth, with a record

Case Studies: Successful Usage of Liquidation Heatmaps

Numerous traders have benefited from utilizing liquidation heatmaps effectively. Consider the following scenarios:

ong>Case Study 1: ong> A trader noticed a significant liquidity cluster forming around Bitcoin at a $40,000 price point. By inputting a et=”_blank” href=”https://cryptohubble.com/?p=7494″>long position just above this level and utilizing a liquidation heatmap, they were able to capitalize on a quick recovery, realizing a profit almost instantaneously.ong>Case Study 2: ong> A trader exploring Ethereum anticipated high liquidation risk as price neared $2,500. By exiting positions before the figure approached this level, they effectively minimized their losses when the price ultimately dipped.

Integrating Liquidation Heatmaps in Your Trading Strategy

In today’s volatile cryptocurrency market, knowledge is power. Here‘s how to efficiently integrate liquidation heatmaps into your trading strategy:

ong>Stay Updated: ong> Regularly check liquidation heatmaps provided by reputable exchanges and websites like ef=”https://www.hibt.com”>hibt.com.ong>Combine Analytics: ong> Utilize other analytical tools aet=”_blank” href=”https://cryptohubble.com/?p=7494″>longside heatmaps, such as volume charts and moving averages, to confirm trends.ong>Develop Exit Strategies: ong> Have a clear exit strategy based on immediate liquidations identified through the heatmap.

Conclusion

Liquidation heatmaps are more than just a fancy visualization tool; they are integral to navigating the crypto landscape effectively. By adopting an analytical approach and remaining informed of potential market movements depicted through these heatmaps, traders can significantly enhance their strategies, mitigate risks, and maximize profits.

As the Vietnamese crypto market continues to expand, tools like liquidation heatmaps will play a pivotal role in steering the course for both novice and experienced traders. An informed trader is a successful trader, so make sure to leverage technology to your advantage.

In the fast-paced world of crypto, staying ahead of liquidation risks with a liquidation heatmap could just be your best asset. Remember, knowledge proxies optimal trading practices; so why not equip yourself with the best tools available?

To never miss out on such opportunities, explore ef=”https://www.cryptohubble.com”>cryptohubble and fortify your crypto trading journey!