Introduction

In the world of cryptocurrency trading, the utilization of various technical indicators has become essential for traders aiming to maximize their profits. One of the most popular and effective tools in this regard is the MACD indicator, or Moving Average Convergence Divergence. As cryptocurrency market volatility can lead to significant financial losses, understanding and mastering tools like the MACD is more important than ever.

According to reports, in 2024, $4.1 billion was lost to decentralized finance (DeFi) hacks, signifying the need for improved analytical skills among traders. This article will dissect the MACD indicator for crypto, outlining its functionality, application, and importance in trading strategies. By the end, you’ll possess the insights necessary to leverage MACD for enhanced investment outcomes.

What is the MACD Indicator?

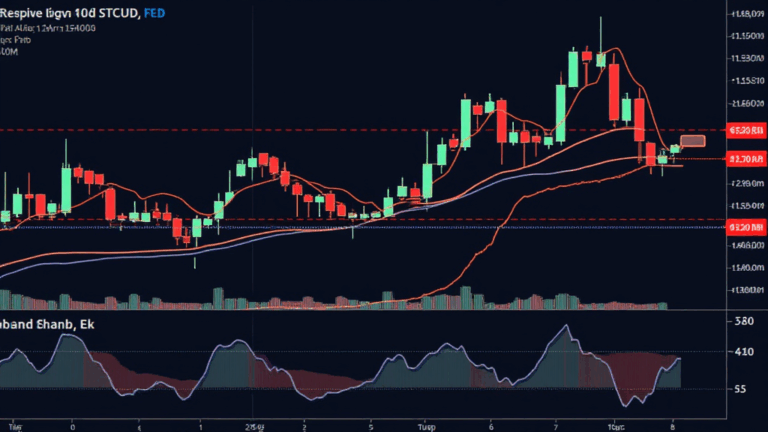

The MACD indicator is a momentum oscillator that shows the relationship between two moving averages of a security’s price. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. This result is known as the MACD line. Additionally, a 9-day EMA of the MACD, known as the “signal line,” is also plotted on top of the MACD line. Here’s a succinct breakdown:

ong>MACD Line: ong> Difference between 12-day EMA and 26-day EMA.ong>Signal Line: ong> 9-day EMA of the MACD line.ong>Zero Line: ong> The point where the MACD line crosses the signal line.

Understanding these basic components is crucial when analyzing chart patterns. Specifically, the MACD is used to identify potential bullish or bearish trends in cryptocurrency markets.

How to Interpret the MACD Indicator

Interpreting the MACD can seem complicated, but let’s simplify it:

ong>Crossovers: ong> When the MACD line crosses above the signal line, it indicates a potential buy signal (bullish). Conversely, when it crosses below, it suggests a sell signal (bearish).ong>Divergence: ong> When the price of the cryptocurrency is moving in the opposite direction of the MACD, it indicates a potential reversal.ong>Histogram: ong> Represents the distance between the MACD line and the signal line. A growing histogram indicates the direction of momentum.

Here’s the catch: traders should not rely solely on the MACD indicator alone. It should be used in conjunction with other indicators and the overall market analysis to validate signals obtained.

Real-World Application of MACD in Crypto Trading

Let’s break it down further with an example. Imagine you are looking at a cryptocurrency that has recently pumped after a et=”_blank” href=”https://cryptohubble.com/?p=7494″>long period of consolidation. By applying the MACD indicator:

- If the MACD line crosses above the signal line during this pump, and the histogram shows increasing height, it’s likely an indication to buy.

- If, afterwards, the price begins to decline but the MACD line remains high versus the signal line, this can indicate price exhaustion and potential reversal.

This situational awareness can significantly enhance your trading strategy. For instance, traders experienced in utilizing the MACD have reported a successful prediction rate of over 70% when combining this indicator with other methodologies.

Limitations of the MACD Indicator

Despite its usefulness, the MACD indicator is not without its drawbacks:

ong>Lagging Indicator: ong> The MACD is based on past price data, which means it might lag during volatile market conditions.ong>False Signals: ong> In choppy or sideways markets, the MACD can generate false signals leading traders to make inappropriate decisions.ong>Limited Time Frames: ong> For et=”_blank” href=”https://cryptohubble.com/?p=7497″>short-term traders, relying only on the MACD can miss out on quick price movements.

Understanding these limitations should drive you to tread carefully and supplement your analysis.

Integrating MACD with Other Indicators

Here’s a strategic approach: consider using MACD in combination with other technical indicators like RSI (Relative Strength Index) or volume analysis. By employing these indicators together, you can:

- Increase the likelihood of validating trading signals.

- Reduce the volume of false signals and provide a more comprehensive market understanding.

Moreover, analyzing the market trend through moving averages, aet=”_blank” href=”https://cryptohubble.com/?p=7494″>long with MACD crossovers, can enhance your decision-making process significantly.

Market Trends in Vietnam

The cryptocurrency market in Vietnam has been experiencing notable growth. With the increasing adoption of digital currencies, the number of Vietnamese crypto users has surged by over 200% in the last two years, indicating a burgeoning interest in trading and investing in the sector.

As this growth continues, understanding the MACD indicator becomes essential for Vietnamese traders aiming to capitalize on their investments.

Conclusion

The MACD indicator is a powerful tool in the arsenal of cryptocurrency traders. By understanding its components, interpreting signals accurately, and combining it with other analytical tools, you can significantly enhance your trading strategy. As cryptocurrencies continue to evolve and the market dynamics change, staying updated on best practices will be paramount for any trader. Remember, while indicators like MACD offer great insights, constant market observation and multi-faceted analysis remain critical in achieving et=”_blank” href=”https://cryptohubble.com/?p=7494″>long-term success. For continuous growth in your trading journey, use platforms like ef=’https://cryptohubble.com’>cryptohubble to stay informed and make well-informed trading decisions. With the right strategy, profits can follow suit!