Introduction

With the rise of decentralized finance (DeFi) and evolving trading strategies, the perpetual contracts market has captivated both novice and experienced traders. In 2024, over

What Are Perpetual Contracts?

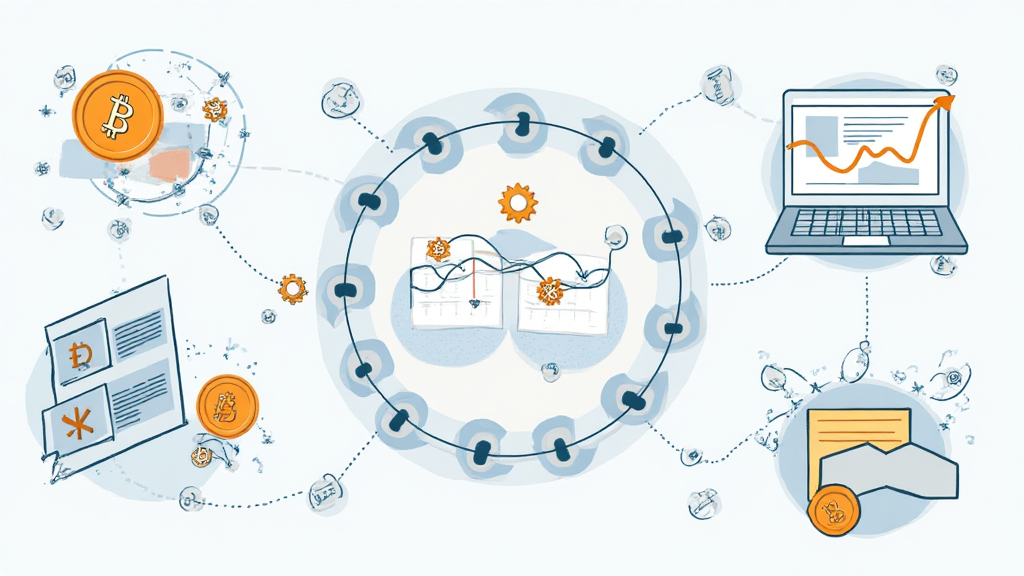

Perpetual contracts are a unique class of derivative that allows traders to speculate on the price of cryptocurrencies without the need for an expiry date. Unlike traditional futures contracts, which expire on a predetermined date, perpetual contracts are continuous and can be held indefinitely. This characteristic makes them attractive for traders seeking flexibility and strategic depth.

How Perpetual Contracts Work

To fully grasp perpetual contracts, it’s essential to understand a few key components:

ong>Margin Trading: ong> Traders use leverage to enhance their positions. A small deposit can control a larger position, magnifying both potential profits and losses.ong>Funding Rate: ong> Perpetual contracts involve a funding mechanism where traders periodically exchange payments to maintain the contract’s price in line with the spot price of the underlying asset. Depending on market trends, this can either be a payment from et=”_blank” href=”https://cryptohubble.com/?p=7494″>longs to et=”_blank” href=”https://cryptohubble.com/?p=7497″>shorts or vice versa.ong>Continuous Price Trends: ong> By tracking the difference between the perpetual contract price and the asset’s spot price, traders can gauge market sentiment and make informed decisions.

The Growth and Popularity of Perpetual Contracts

According to a 2025 report by ef=”https://www.hibt.com” target=”_blank”>hibt.com, the volume of perpetual contracts in the crypto market has surpassed traditional futures, signaling a shift in trading preferences among retail and institutional investors alike. In Vietnam, the user growth rate for crypto trading platforms exceeded

Advantages of Perpetual Contracts

Perpetual contracts offer several benefits:

ong>Flexibility: ong> Traders can hold their positions indefinitely, allowing for et=”_blank” href=”https://cryptohubble.com/?p=7494″>long-term strategies or et=”_blank” href=”https://cryptohubble.com/?p=7497″>short-term trades based on market conditions.ong>Access to Leverage: ong> With margin trading, traders can amplify their positions, potentially leading to higher profits. However, it’s crucial to manage risk to avoid significant losses.ong>No Expiration: ong> Unlike traditional futures, perpetual contracts do not expire, eliminating the need to roll over contracts as expiry approaches.

Risks Involved With Perpetual Contracts

While perpetual contracts can be advantageous, they also come with their own set of risks:

ong>Market Volatility: ong> The crypto market is notoriously volatile, and leveraging positions can lead to rapid and significant losses.ong>Liquidation Risk: ong> If the market moves too far against a trader’s position, their account may face liquidation, resulting in a total loss of invested capital.ong>Funding Rate Payments: ong> Depending on market conditions, traders may incur additional costs in the funding payments, affecting overall profitability.

How to Manage Risks

To successfully trade perpetual contracts, here are some practical tips:

ong>Use Stop-Loss Orders: ong> Implementing stop-loss orders can help manage unexpected market movements.ong>Stay Informed: ong> Regularly monitor market trends, news, and technical indicators to make educated trading decisions.ong>Invest Only What You Can Afford to Lose: ong> Avoid over-leveraging and only invest funds you are willing to lose, especially in the highly volatile crypto environment.

Perpetual Contracts in the Vietnamese Market

The perpetual contract market in Vietnam is rapidly evolving. According to a recent report, the user growth rate for crypto trading platforms exceeded

It’s essential for traders in Vietnam to implement strategies that cater to their specific market conditions. Understanding local trading behaviors and preferences can significantly enhance trading efficiency and profitability.

Conclusion

Perpetual contracts represent a transformative financial instrument in the crypto space, allowing traders greater flexibility and access to diverse trading strategies. However, with this flexibility comes the necessity for careful risk management and a keen understanding of market dynamics. As the crypto landscape continues to evolve, traders armed with knowledge about perpetual contracts will be better positioned to navigate its complexities.

In conclusion, whether you’re an experienced trader or just starting, understanding

For more insights and guidance on crypto investments, visit ef=”https://www.cryptohubble.com” target=”_blank”>cryptohubble.