Understanding Support and Resistance in Crypto

With the cryptocurrency market experiencing exponential growth, it’s crucial for traders to understand pivotal concepts like support and resistance. These two foundational principles are essential for making informed trading decisions. In Vietnam, crypto adoption has surged, showcasing a user growth rate of 25% over the past year, making it even more vital to grasp these concepts.

What Are Support and Resistance?

Support and resistance are levels on a price chart that indicate the potential stopping points for price movements. Let’s break it down:

ong>Support: ong> This is a price level where buying interest is strong enough to overcome selling pressure. When the price approaches this level, it often bounces back upwards.ong>Resistance: ong> Conversely, resistance is a price point where selling interest is sufficient to push price down. When prices hit resistance, they typically fall back.

Both concepts are critical for traders looking to anticipate price movements and strategize their next moves effectively.

Why Are Support and Resistance Important?

Using support and resistance can significantly enhance your trading strategy. Here’s how:

ong>Trading Signals: ong> Support and resistance levels serve as clear indicators for traders on when to buy or sell.ong>Risk Management: ong> Identifying these levels can help traders set stop-loss orders to minimize potential losses.

For instance, if a trader sees Bitcoin approaching a support level, they might consider it a buying opportunity. Alternatively, as it approaches resistance, they could decide to sell.

How to Identify Support and Resistance Levels

Identifying these levels requires a blend of technical analysis and understanding market dynamics. Here are some common methods:

ong>Historical Price Levels: ong> Look for previously established highs and lows.ong>Trend Lines: ong> Drawing lines connecting lows can indicate support, while connecting highs can indicate resistance.ong>Moving Averages: ong> Popular moving averages can also act as dynamic support or resistance levels.

Contemporary tools, like those offered by platforms such as ef=”https://hibt.com”>HIBT, can help visualize these levels effectively, giving traders a clearer picture.

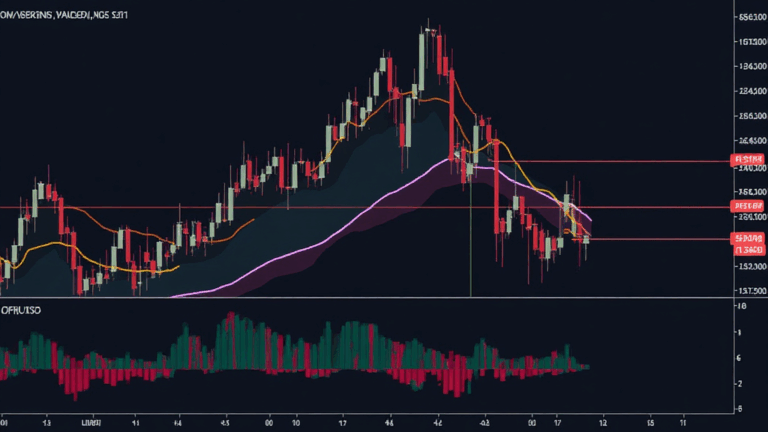

Support and Resistance in Action: A Case Study

To illustrate the effectiveness of support and resistance, let’s look at a recent trading scenario involving Ethereum. On March 15, 2024, Ethereum tested a support level of approximately $1,800 before bouncing back to $2,000 within days. This is a classic example where identifying support helped traders capitalize on the upswing.

ead> ead>

March 15, 2024

$1,800

Buy signal triggered

March 20, 2024

$2,000

Sell signal generated

e>

The Impact of Market Sentiment

Market sentiment plays a vital role in establishing these support and resistance levels. In Vietnam, factors such as regulatory changes and social media trends can cause rapid price fluctuations. Keeping an eye on such sentiments can help traders navigate the volatile crypto landscape.

Best Practices for Trading with Support and Resistance

1. Combine with Other Indicators: Use support and resistance in conjunction with other technical indicators like MACD or RSI to confirm signals.

2. Stay Updated: Keep abreast of market news, as external factors can drastically alter support and resistance levels.

3. Practice Risk Management: Set stop-loss orders at or just below support levels to protect against unexpected downturns.

Conclusion

Understanding support and resistance in crypto trading is essential for every trader, especially in emerging markets like Vietnam. As user growth and engagement increase, so does the need for effective strategies. Developing a solid grasp of these concepts will empower you to make more informed decisions in the crypto space.

If you’re looking to enhance your trading skills and stay ahead in the volatile crypto market, start implementing support and resistance techniques today. Remember, though, that these strategies aren’t foolproof and should be complemented by a well-rounded trading strategy.

For more comprehensive insights into crypto trading strategies, visit cryptohubble!